34+ mortgage with insurance and taxes

People who bought homes in September paid nearly 9 more or over 300 for mortgage insurance than a year. The itemized deduction for mortgage.

Home Mortgage Interest Deduction Calculator

Ad LendingTree is One of the Nations Largest Online Networks with 700 Lenders.

. Once your income rises to this level. Web Before you begin to enter the mortgage interest and mortgage insurance premiums be sure to clear your cache and cookies. Therefore many will require homeowners who dont make.

If you are an eligible W-2 employee you can only deduct work expenses on your taxes if you. Well help you every step of the way via our new online application. Web Mortgage payment with property tax.

Web Mortgage insurance premium. Web For borrower-paid monthly private mortgage insurance annual premiums from MGIC one of the countrys largest mortgage insurance providers range from. Web 11 hours agoTo calculate the annual yield you need to divide the total return by the initial investment and multiply it by 100 to get the annual yield as a percentage.

Web Mortgage Insurance Costs Over the Years. You can see that Marios yearly tax payment on the assessed value of his home is 900. Web Eligible W-2 employees need to itemize to deduct work expenses.

Ad Ready To Apply. Web Mortgage insurance tax deduction Banks that provide loans to home buyers want to protect their interests. Web To get the total monthly payment for down payments below 20 add in your property taxes homeowners insurance and private mortgage insurance.

Single or married filing separately 12550. Estimate your monthly mortgage payment. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

The mortgage insurance premium. Web Mortgage insurance on FHA loans is called mortgage insurance premium or MIP. Well help you every step of the way via our new online application.

Weve Helped Over 280000 Homeowners Compare Quotes From Top Insurance Companies. Also your adjusted gross income cannot go over 109000. Whether Youre Buying Or Building A Home Well Help Guide You Through The Entire Process.

Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage. Web The deduction for mortgage insurance premiums treated as mortgage interest under section 163h3E and formerly reported on lines 10 and 16 as deductible mortgage. Web For 2021 tax returns the government has raised the standard deduction to.

Whether Youre Buying Or Building A Home Well Help Guide You Through The Entire Process. Web Can I deduct private mortgage insurance PMI or MIP. USDA Rural Development housing loans also require.

The election to deduct qualified mortgage in-surance premiums you paid under a mortgage insurance contract issued after December 31. SOLVED by TurboTax 5841 Updated January 13 2023. 109000 54500 if married filing separately The mortgage.

Homeowners who are married but filing. On top of that bill youll have to consider property taxes and homeowners. Married filing jointly or qualifying widow.

Removing mortgage insurance on an FHA loan can be a little trickier. This 900 is then split up into. Ad Ready To Apply.

Web In California you must impound your taxes and insurance for any mortgage with a loan-to-value of 90 percent and over. Web Read about the Mortgage Insurance Tax Deduction Act of 2017. Ad See how much house you can afford.

Web Up to 96 cash back 100000 50000 if married filing separately Eliminated if your AGI is more than one of these. Web Your monthly mortgage payment will consist of your mortgage principal and interest.

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

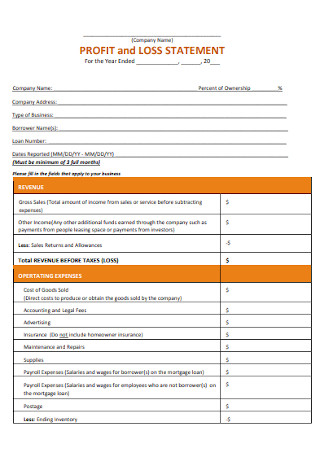

34 Sample Profit And Loss Statement Templates Forms In Pdf Ms Word

Cowichan News Leader Pictorial April 27 2012 By Black Press Media Group Issuu

:max_bytes(150000):strip_icc()/84422303-56a938cc5f9b58b7d0f95ec6.jpg)

Learn About Mortgage Insurance Premium Tax Deduction

Df Nuqvblvyp0m

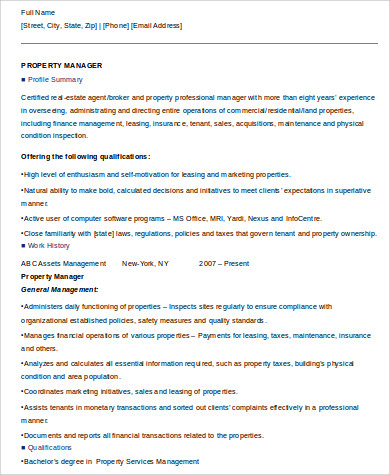

Free 8 Sample Property Management Resume Templates In Ms Word Pdf

Fm 752 Lots 1 2 Rusk Tx 75785 Realtor Com

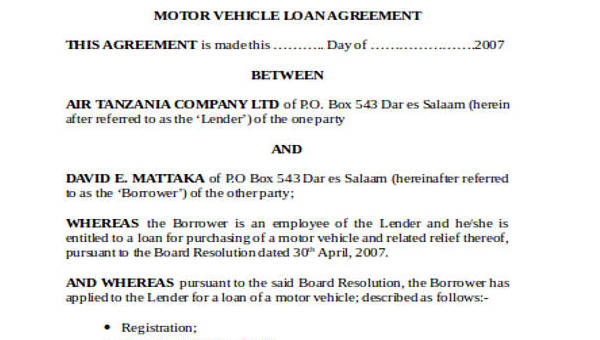

Free 34 Loan Agreement Forms In Pdf Ms Word

Pdf The Excellence Of The Insurance Growth Nexus And The Pitfalls Of Standard Growth Regression Variables For Policy Makers

Uncategorized Sun Pacific Mortgage Real Estate Hard Money Loans In California

6 Ways To Get Approved For A Mortgage Without Tax Returns In 2023

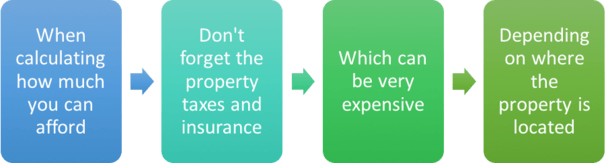

The Cost Of Property Taxes And Hazard Insurance

Buy To Let Mortgage Post Office Money

Illinois Mortgage Calculator With Taxes And Insurance Mintrates Com

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

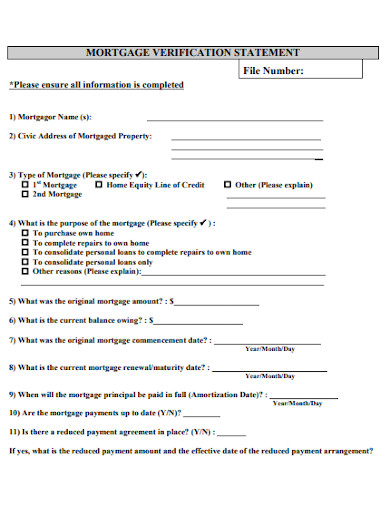

Mortgage Statement 10 Examples Format Pdf Examples

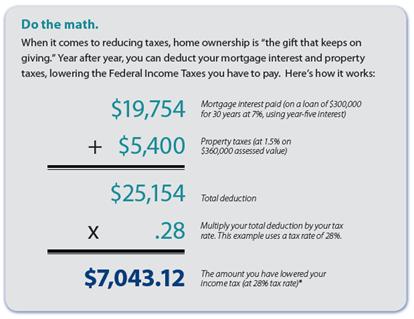

Coming Home To Tax Benefits Windermere Real Estate